Zeno employees running to raise $20,000 for KidSport

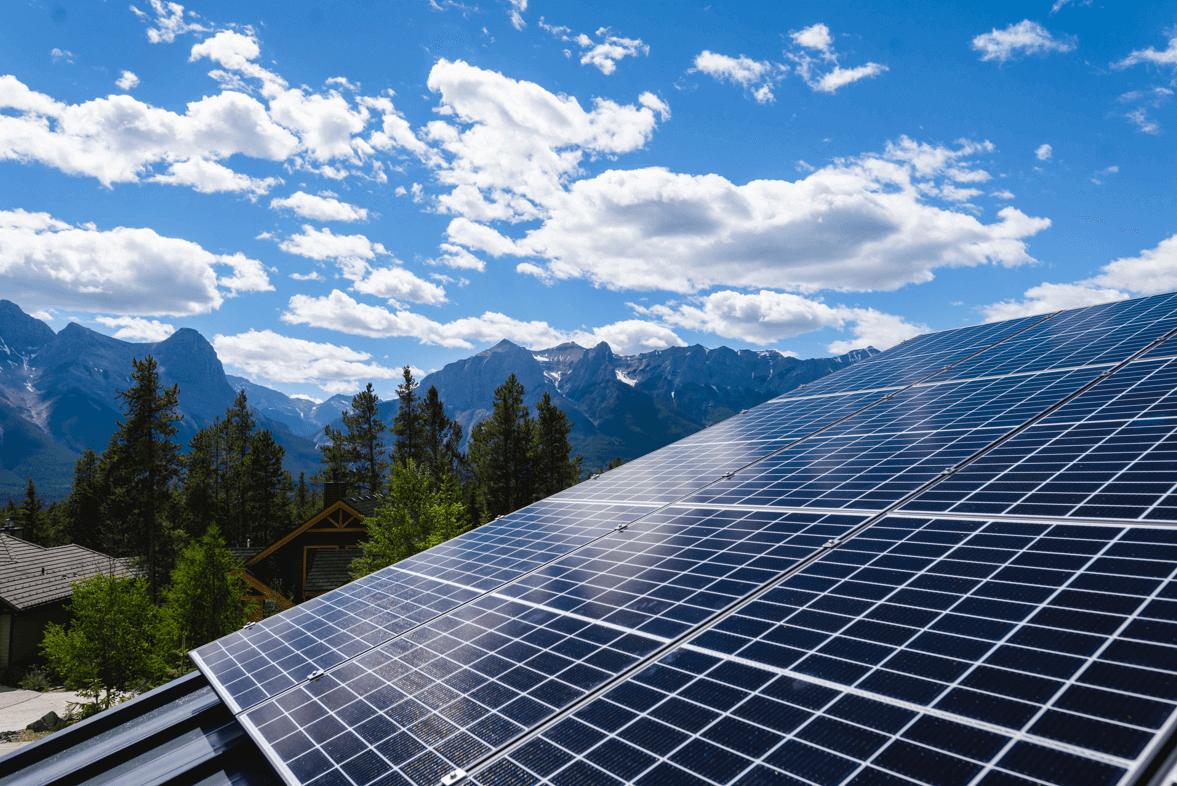

It takes a bold group of people to create a world where living sustainably is easy for everyone. Our goal is to install solar solutions on over 1 million homes by 2040. Together, we can make a difference. Are you ready to join the movement?

Every home can make a difference, no matter where you live. That’s why we make it easier to bring custom solar solutions into the homes of people who care as much as we do.

Explore SolutionsDrive into a future where technology and nature work together. Our Tesla-certified team works with the industry’s best to bring EV charging stations to more homes and businesses everywhere.

Learn MoreElectricity on your terms. Keep the lights on with excess, stored energy from your solar panels when the sun goes down.

Learn More

We stand by our solar installations with a Lifetime Craftsmanship Warranty, ensuring your investment is protected with guaranteed quality and durability.

Our Money-Back Production Guarantee ensures optimal performance and your satisfaction. If our panels don’t meet the expected output, we’ll refund you, securing your investment.

At Zeno, our quality guarantee is unmatched. We employ only trained, certified electricians and enforce a rigorous quality control review process. With the industry’s best full-time service team, we ensure excellence in every aspect of our work.

We’re pioneering new innovative ways of bringing solar solutions to homes and communities across Canada. Here are just a few of our recent projects.

We started Zeno to empower people who want to do their part in reducing humanity’s environmental impact so we can secure our home planet for future generations.

Learn moreWe want to hear your vision. Reach out to our experts with your ideas and sustainable energy needs, and let’s start designing a sustainable future together.

Contact Us